b&o tax seattle

Free Case Review Begin Online. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services.

Understanding The Mayor S Proposed Budget Revenues

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

. Business Occupation Taxes. Create a tax preparer account to file returns for multiple clients example. Seattles BO tax is generally imposed on all persons engaging in business activity within the city.

Manufacturing Wood Biomass Fuel. See also Wholesaling of Solar Energy on this page. Service other activities015.

Returns are not deemed filed until both tax filing and. Create a business account to register your business file returns and pay local BO taxes. You pay the tax if your annual taxable gross revenue is 100000 or more.

The Seattle tax law attorneys at Insight Law handle all Washington State Business and OccupationBO Tax Audit Issues. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. RCW 820802573 provides a comparable retail sales tax exemption for qualified nonprofit organizations for amounts received from certain fundraising activities.

The tax rate is 0138 percent. 3 In 2006 KMS successfully defeated an effort by Seattle to impose a BO tax on KMS based on all commissions received in the KMS Seattle office regardless of where the registered representative generating the commission was based. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

Think the Apple Cup but with lots more money at stake. 4 The Court held that the position. If you have questions please call 206 684-8484 or email.

It is measured on the value of products gross proceeds of sale or gross income of the business. The BO is a tax on gross receipts. Open Monday through Friday 830 am-4 pm.

Box 34214 Seattle WA 98124-4214. If you manufacture wood biomass fuel report the income under Manufacturing of Wood Biomass Fuel BO tax classification. Nobody likes taxes but people really really hate the levy Washington imposes on businesses.

Business occupation tax classifications. The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories. The state BO tax is a gross receipts tax.

BEFORE YOU GET STARTED. Build an Effective Tax and Finance Function with a Range of Transformative Services. Call 206-922-8078 for a free consultation.

Have a Seattle business license see the due dates for that here file a business license tax return. 32 rows Business occupation tax classifications Print. Specialized BO tax classifications.

Ad Based On Circumstances You May Already Qualify For Tax Relief. Manufacturing Processing for Hire Extracting Printing Publishing Wholesaling and. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

See If You Qualify For IRS Fresh Start Program. The BO tax rate is 0275 percent. The tax amount is based on the value of the manufactured products or by-products.

Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax. Manual forms can be completed and mailed to the address provided on the back of the form. RCW 82043651 provides a business and occupation BO exemption to qualified nonprofit organizations for amounts received from certain fundraising activities.

Although there are exemptions every person firm association or corporation doing business in the city is subject to the BO tax. If you do business in Seattle you must. Called the Business Occupation Tax the BO is loathed with the intensity usually reserved for your college football teams archrival.

However you may be entitled to the. Washingtons BO tax is calculated on the gross income from activities. FileLocal is the online tax filing portal for the City of Seattle.

License and tax administration 206 684-8484 taxseattlegov. CPAs and accounting firms. CREATE BUSINESS ACCOUNT View the Taxpayer Quick Start Guide.

The City of Seattle Department of Finance and Administrative Services will defer business and occupation BO tax collections for businesses that have annual taxable incomes of 5 million or less and that pay city taxes quarterly. Requires the business to file an Annual Tax Performance Report. This is the same portal many taxpayers currently use to file and pay a variety of other Seattle business taxes including BO Commercial Parking Admissions etc.

Extracting Extracting for Hire00484. Washington unlike many other states does not have an income tax. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

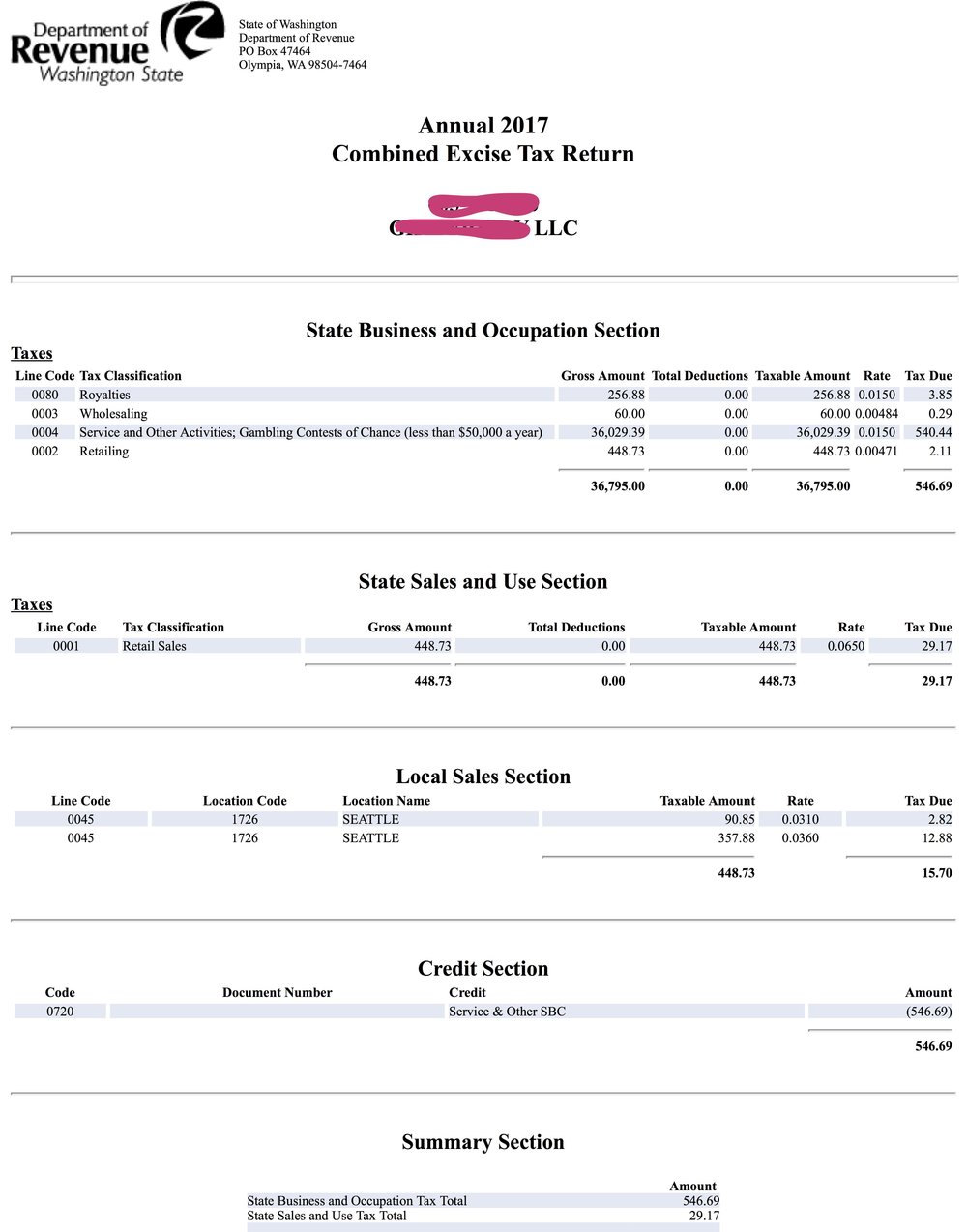

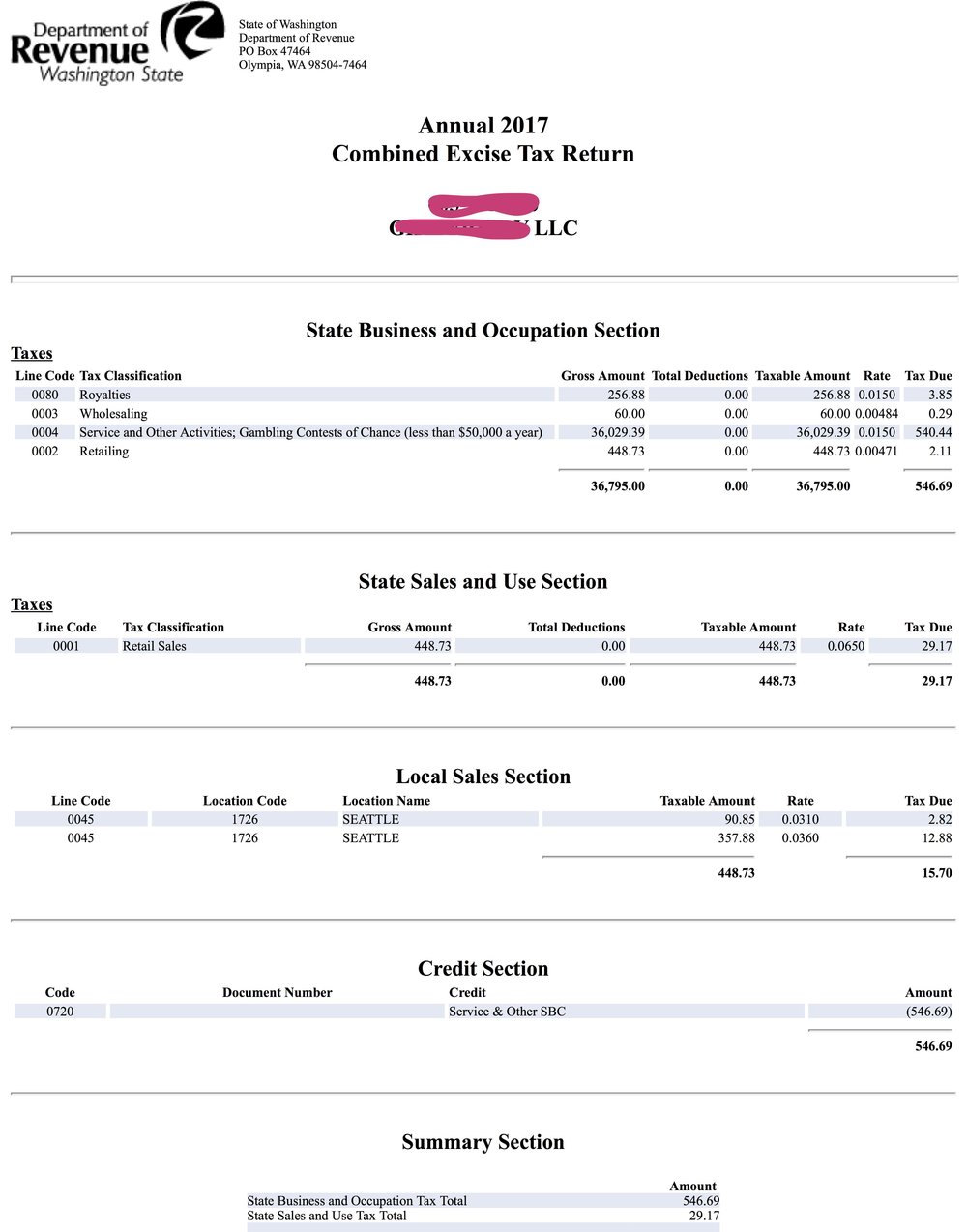

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

State Lawmakers Eye Taxes On Business And Wealthy Don T Lead With Taxes Helped State Recover From Great Recession Opportunity Washington

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

State Lawmakers Eye Taxes On Business And Wealthy Don T Lead With Taxes Helped State Recover From Great Recession Opportunity Washington

Understanding The Mayor S Proposed Budget Revenues

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Understanding The Mayor S Proposed Budget Revenues

Understanding The Mayor S Proposed Budget Revenues

Business And Occupation Tax Credit Commute Seattle

Understanding The Mayor S Proposed Budget Revenues

Business And Occupation Tax Credit Commute Seattle